Two calls to chase card benefits confirmed that both cards still offer price protection up to 500 per item and 2 500 per year when a lower price is found within 90 days of the purchase.

Chase sapphire preferred price protection exclusions.

Please see your guide to benefits for complete details.

This coverage is sometimes called loss damage waiver or ldw.

The item must be purchased with an eligible chase card or rewards earned on an eligible chase card.

Barclaycard usaa citi capital one chase mastercard and discover all currently have price protection programs.

Provide your chase sapphire preferred when reserving picking up and completing the car rental transaction.

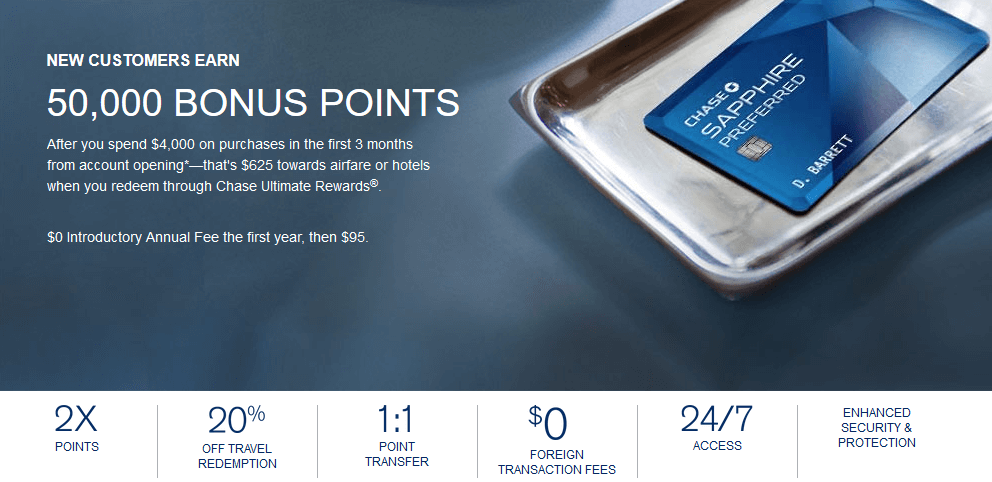

Apply for a sapphire preferred travel credit card today.

If a purchase you made with the card in the u s.

500 per item 2 500 per.

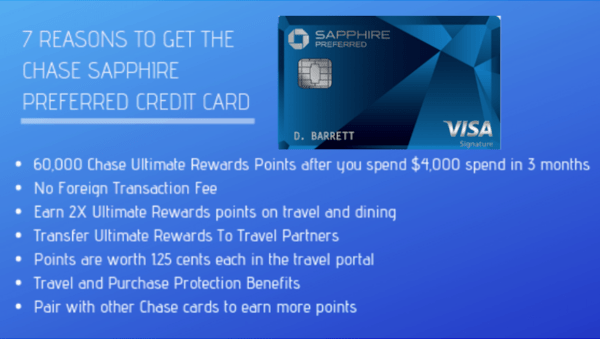

Chase sapphire preferred is the rewards travel credit card that awards you 2x points on travel and dining.

Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the.

Sapphire sapphire sapphire reserve sapphire preferred jpm reserve ink bold ink plus ink preferred and select partner cards.

All price protection programs share some similarities.

The following information is a summary only.

Decline the rental car company s cdw coverage.

The card s strengths include its ability to earn valuable chase ultimate rewards points on every purchase the variety of redemption options it offers and even its shopping benefits.

Your guide to benefits has what you need to know about the travel and purchase protection benefits that come with your card what s covered not cove.

The chase sapphire preferred card is a solid choice for your first travel rewards credit card.

Can repair replace or reimburse you for eligible items in the event of theft or damage when items are purchased with an eligible chase card or with rewards earned on an eligible chase card.

Earn 80 000 bonus points after you spend 4 000 on purchases in the first three months from account opening.

In addition to the key benefits of strong earning power and travel redemption flexibility the chase sapphire.

Price protection was removed from other united cobranded cards and most other chase cards in 2018 but this card still offers price protection.

Coverage is secondary to and in excess of store policies offering low price guarantees or any other form of refund for price differences.

So the big question is.

Why did chase say price protection would be removed from all cards yet leave price protection as a benefit on the ihg co branded ones.

Up to 500 per item maximum 2 500 per year.

Restrictions limitations and exclusions apply.