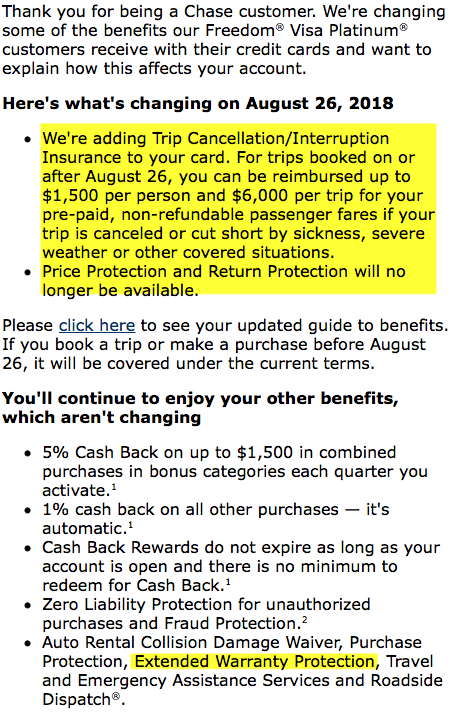

In very basic terms the chase price protection plan offered cardholders the chance to claim the difference between the actual purchase price of an item and a lower advertised price if spotted either online or in print within 90 days of the purchase date.

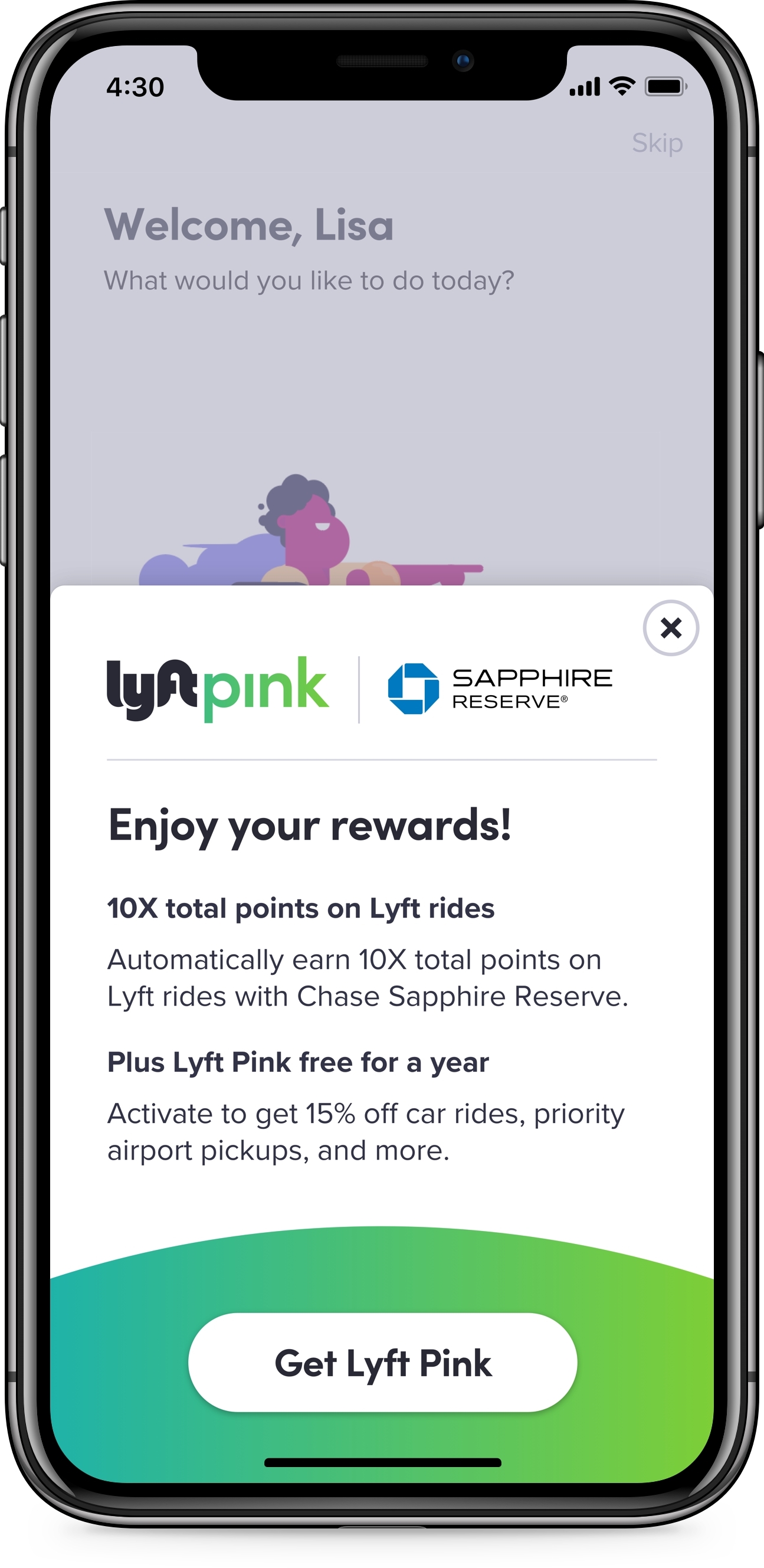

Chase sapphire reserve purchase price protection.

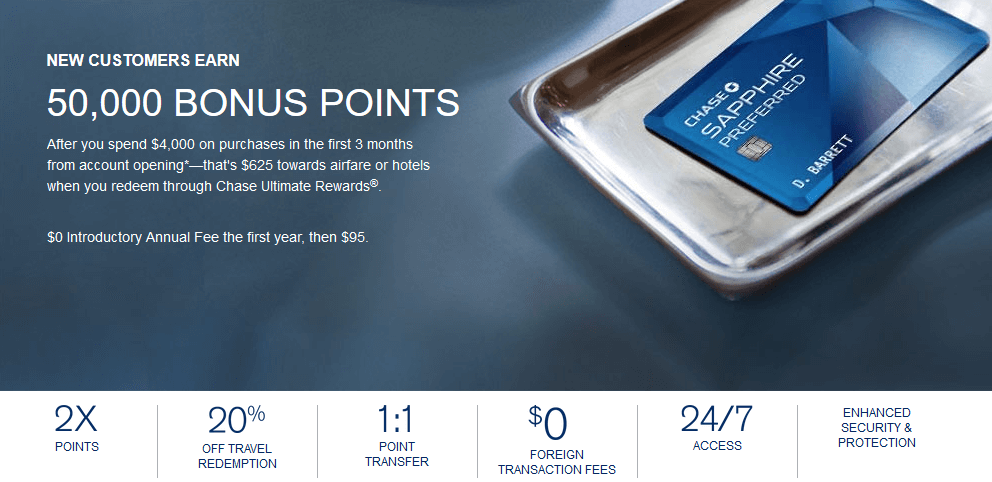

The chase sapphire reserve and the chase sapphire preferred have very different purchase protection limits.

Chase price protection price protection provides reimbursement for the difference in price between what you paid for an item and a lower advertised price within 90 days of purchase.

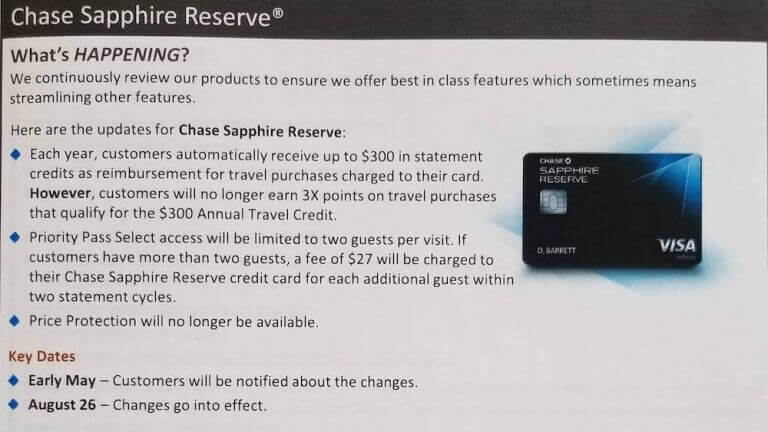

Price protection this benefit will be discontinued on 8 26 2018.

What was the chase sapphire reserve price protection plan.

This used to be a widespread benefit offered by many chase credit cards.

Final word these travel and purchase protections above are some of the best that you will find with any travel rewards credit card.

Up to 500 for each eligible item maximum 1 000 per year.

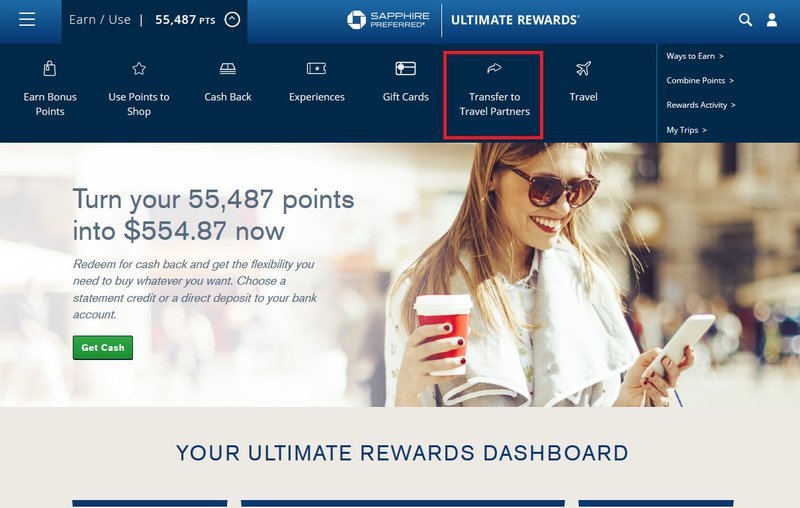

Your guide to benefits has what you need to know about the travel and purchase protection benefits that come with your card what s covered not cove.

The chase sapphire preferred full review here only gets coverage up to a maximum of 500 per claim and up to 50 000 per account while the sapphire reserve gets up to 10 000 per claim.

However as of 8 26 18 it was removed from all but 6 cards.

Benefits are capped at 250 per item and 1 000 annually per card account.

The following information is a summary only.

Return protection you can be reimbursed for eligible items that the store won t take back within 90 days of purchase up to 500 per item 1 000 per year learn more.

Pays the overage if the cardholder sees within 30 days of making a qualified purchase an identical item advertised in print at a lower price than originally paid.

Please see your guide to benefits for complete details.

/chase-sapphire-preferred-d8cc6e87e5474245b576947076252332.jpg)

/images/2019/04/29/charming-american-woman-holding-a-chase-sapphire-card.jpg)